Hello Everyone,

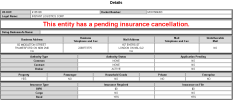

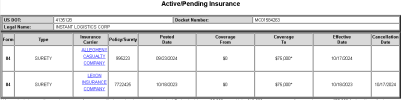

I am writing here today as I have received information on Instant Logistics. They have failed to pay a lot of carriers and received payment from their end customer. The master mind behind this is a person named FIN. I know it is fake name but the director is the culprit.

I am writing here today as I have received information on Instant Logistics. They have failed to pay a lot of carriers and received payment from their end customer. The master mind behind this is a person named FIN. I know it is fake name but the director is the culprit.